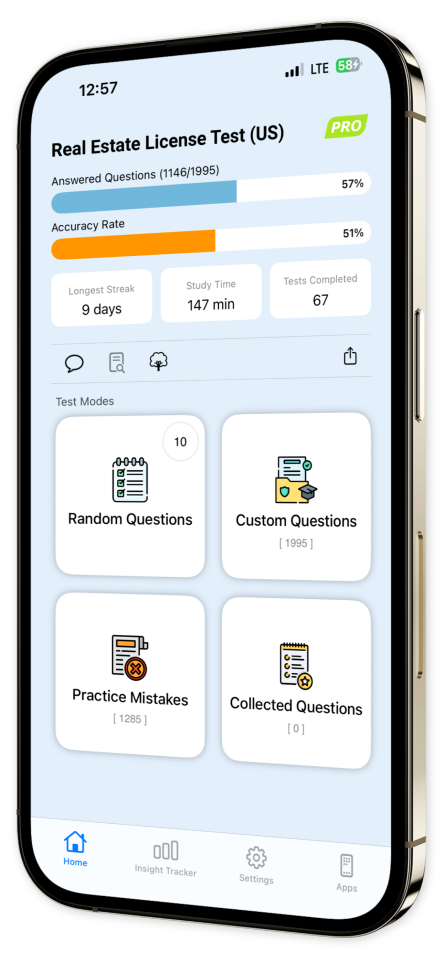

Real Estate License Test (US) iOS

Transform your Real Estate License exam preparation with Real Estate License Test (US)! Our app is meticulously designed to simulate a realistic test environment, equipping you with the knowledge and confidence you need to pass with flying colors. Explore a vast array of practice questions that delve into every critical area for your real estate journey. Each question comes with comprehensive explanations to deepen your understanding and ensure you’re well prepared.

Key Features:

Extensive Question Bank: Discover hundreds of practice questions covering vital topics to guarantee a well-rounded exam preparation.

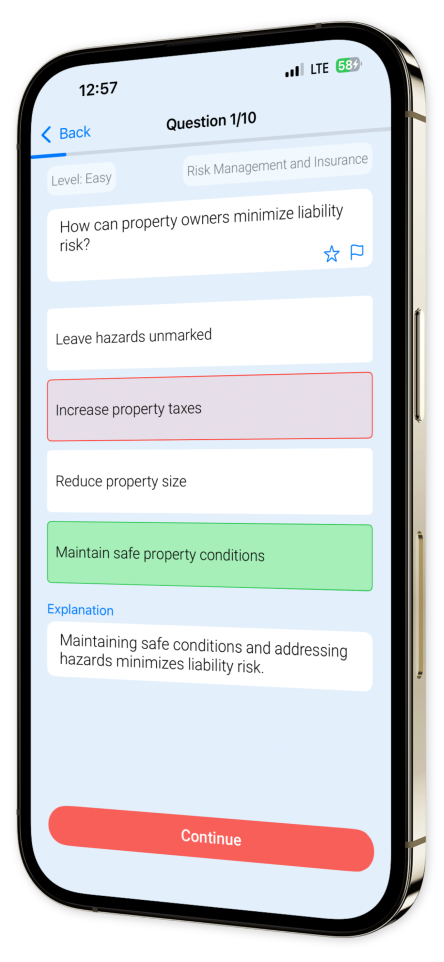

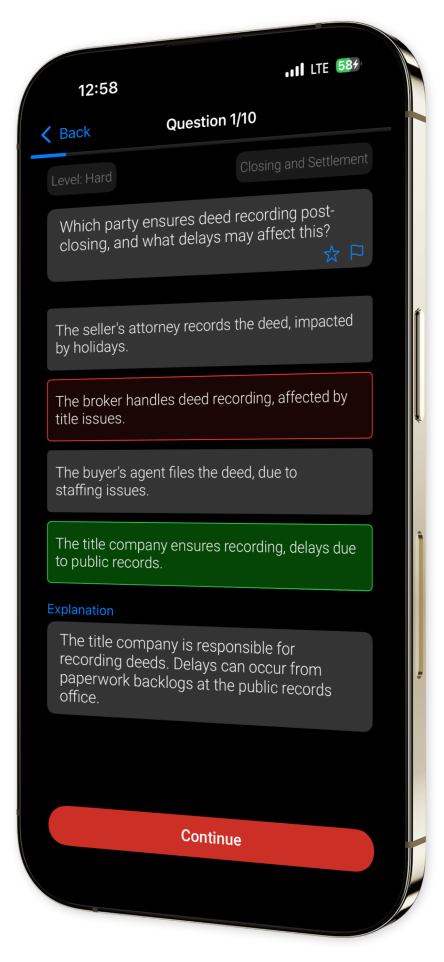

In-Depth Explanations: Learn more from every question with thorough rationales to boost your knowledge and retention.

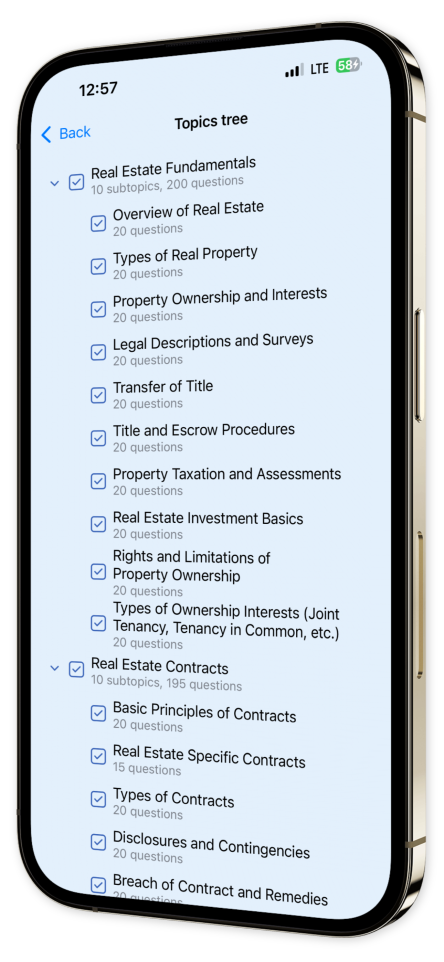

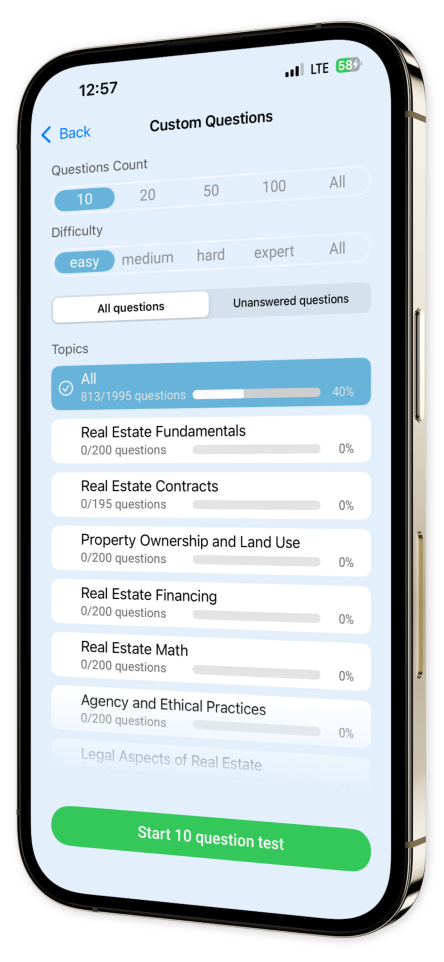

Custom Test Creation: Craft personalized quizzes by selecting specific subjects and question types, focusing your study time on areas that need improvement.

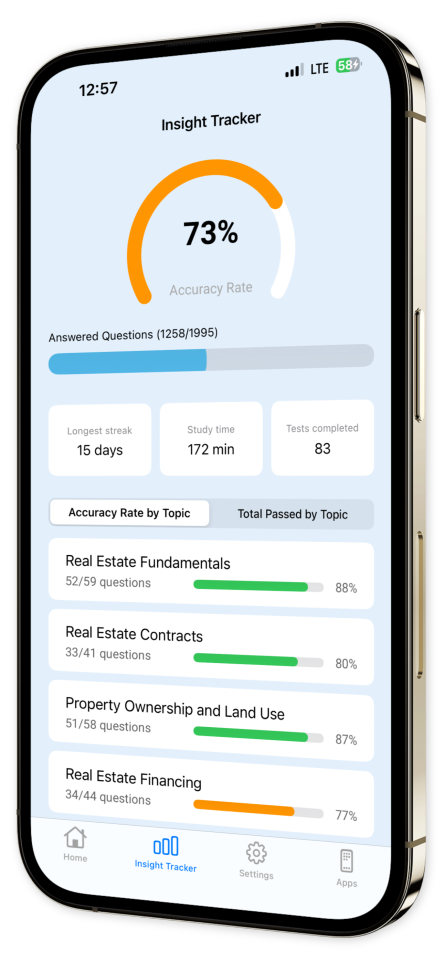

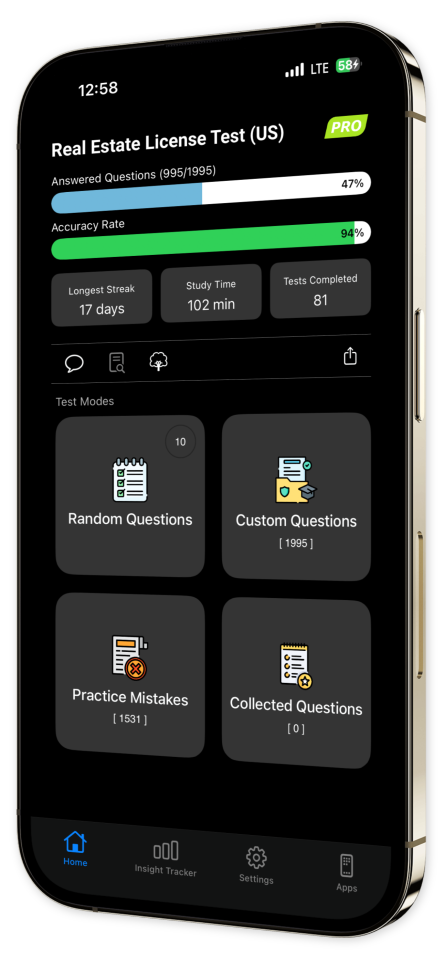

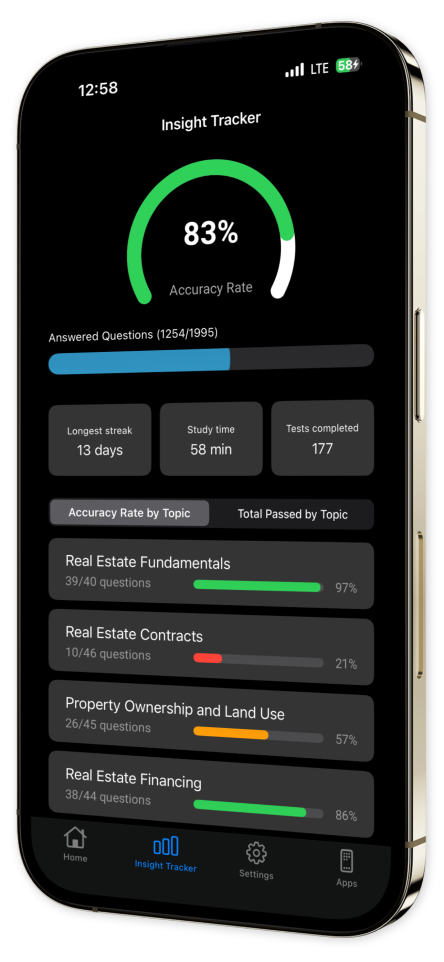

Progress Tracking: Monitor your advancement over time with our user-friendly progress tracking tools.

Offline Access: Keep studying anytime, anywhere, even without the internet, perfect for learning on the move.

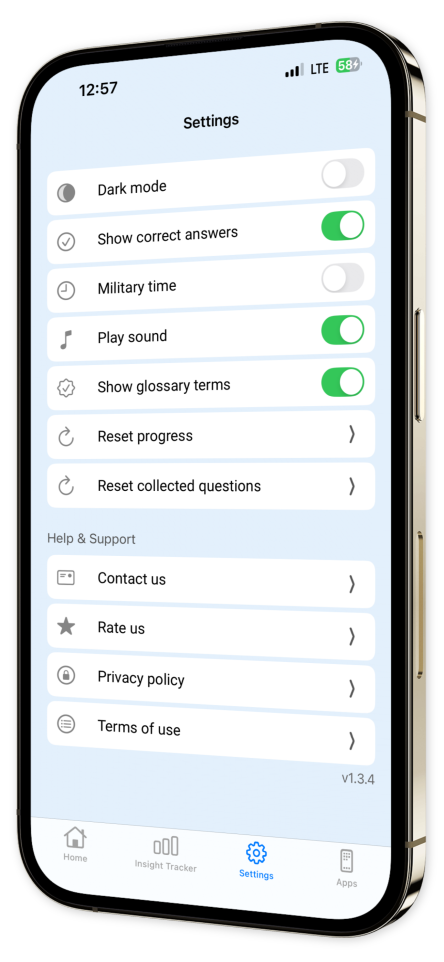

User-Friendly Interface: Enjoy an intuitive and streamlined app interface that keeps your focus on mastering the material.

Download Real Estate License Test (US) today and embark on a smarter, more effective way to prepare for your Real Estate License exam!

Supercharge your future with knowledge.

Join countless others in successfully achieving your real estate career dreams.

Your success journey begins with a single download.

Content Overview

Explore a variety of topics covered in the app.

Example questions

Let's look at some sample questions

What is the primary purpose of zoning laws?

To maintain property taxesTo regulate land useTo improve public transportationTo increase real estate prices

Zoning laws are designed to regulate how land can be used in certain areas, such as residential, commercial, or industrial purposes.

How does a cooperative differ from traditional homeownership?

Ownership feeDirect property ownershipMembership in corporation owning propertyProperty tax advantages

In a cooperative, you own shares in a corporation owning the building, not individual property ownership.

Which of the following best describes a fee simple defeasible estate?

Absolute ownershipOwnership with certain conditionsLimited leaseholdRight of first refusal

A fee simple defeasible estate is ownership with certain conditions that, if violated, could result in loss of the estate.

Apartments are primarily which type of real estate?

ResidentialCommercialIndustrialAgricultural

Apartments fall under residential real estate as they are used for people to live in.

Which type of property is typically used for manufacturing or production?

ResidentialCommercialIndustrialAgricultural

Industrial property is used for manufacturing, production, distribution, and storage of goods.

Calculate annual property tax for a commercial property priced at $500,000 with a tax rate of 1.2%.

$6,000$7,200$5,000$4,800

Annual property tax = $500,000 * 0.012 = $6,000. Verified calculation: $500,000 * 0.012 = $6,000.

A property owner subdivides land into 4 lots. 2 are worth $150,000 each, and the other 2 total $300,000. What is the average lot value?

$150,000$200,000$225,000$250,000

The total value of all lots is $150,000 + $150,000 + $300,000 = $600,000. Dividing by the number of lots, 4, gives $600,000 / 4 = $150,000. Verify: $600,000 ÷ 4 = $150,000.

Which type of estate grants the greatest degree of ownership rights in real property?

Fee Simple AbsoluteLife EstateLeasehold EstateFee Tail

Fee Simple Absolute grants complete ownership rights that can be inherited, sold, or bequeathed entirely, without limitations attached by the prior owner.

What is the term for the right to use land owned by another for a specific purpose?

EasementEncroachmentDeedLease

An easement allows the holder to use land owned by someone else for a precise purpose. Examples include utility easements and right-of-way easements.

What type of ownership allows a married couple to own property equally, with the survivorship right upon death of one spouse?

Tenancy by the EntiretyCommunity PropertyTenancy in CommonJoint Tenancy

Tenancy by the Entirety is a form of concurrent estate held by a married couple, which allows them equal ownership and a right of survivorship.